Setting the Stage:

While the bank’s legacy systems are robust and proven over time, they pose significant challenges to the seamless adoption of new business features. The inflexible architecture and outdated interfaces hinder the swift integration of relevant modern technologies. The complexity arises as these systems were not originally designed for the agility demanded in today’s dynamic financial landscape. The importance of modernization, agile development, and comprehensive testing cannot be emphasized enough in overcoming these hurdles. For instance, the adoption of FedNow instant payments is particularly challenging due to legacy systems not being initially crafted for real-time transaction processing. To offer instant payment services, meticulous consideration is needed in modernizing legacy payment systems where needed, bridging functional gaps, optimizing infrastructure for scalability, and rigorous testing across all functional components and integration points.

The Testing and Development Challenges:

FedNow is a revolutionary real-time payment service initiated by the Federal Reserve, offering financial institutions the capability to provide instant and secure payment options to their customers. Banks recognize the opportunities inherent in FedNow, including the ability to enhance customer experience through immediate fund availability, streamline business transactions, and stay competitive in the evolving financial landscape. They are actively pursuing these opportunities by integrating FedNow into their systems to provide seamless and instantaneous payment solutions, meeting the growing demand for real-time transactions. Certainly, alongside the opportunities come inherent challenges and risks, particularly concerning the modernization of associated system components for generating, processing, and overseeing ISO 20022 format payment messages. Additionally, ensuring seamless integration with the FedNow payment infrastructure, and meeting the required scale and performance benchmarks presents intricate complexities. Addressing these functional and performance challenges is critical not only for enhancing customer satisfaction but also for mitigating potential financial and reputational risks that banks might encounter.

Testing ISO 20022 message formats and flows across participating entities might seem straightforward, but the complexity amplifies when both FedNow and other bank environments are not accessible during the construction and modernization phases.

Unveiling the FedNow Simulator:

Simulators serve as indispensable tools in testing strategies, offering a controlled environment to replicate real-world scenarios. This allows the testing team to validate system responses under various conditions, ensuring robustness and reliability in real-world usage. Simulators also contribute to efficient testing cycles, accelerating the identification and resolution of issues. In testing FedNow ISO 20022 format messages, the simulator stands as a critical asset, providing a controlled environment to replicate scenarios and validate system responses.

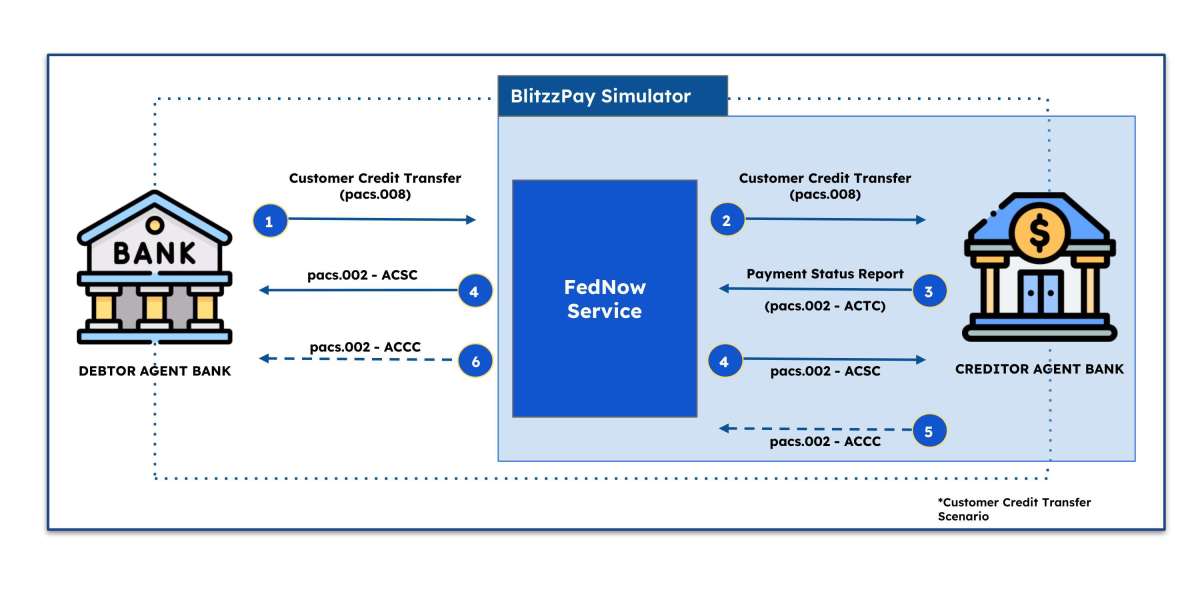

Messages within the FedNow system, utilizing the ISO 20022 schema, are expansive and intricate, governed by numerous business rules. Implementing a cohesive participation model across various transactions like customer credit transfer (pacs.008), Financial Institution credit transfer (pacs.009), and Request for Payment (RFP) (pain.013) requires banks to develop, process, and execute distinct message flows while validating the associated business rules. Without a simulated environment comprising FedNow and creditor/debtor banks, comprehensively testing these diverse message flow scenarios and validating the intricate business rules becomes challenging

A FedNow simulator plays a critical role in ensuring the successful rollout of the instant payment service empowered by FedNow for Financial Institutions.

- Testing and validation of internal systems in a controlled environment

- Identifying issues and bugs and addressing them for a reliable and secure service

- Training and familiarization with the FedNow message formats and workflows

- Supporting internal and 3rd party integrations where required in the business workflows

- Rollout planning with confidence and based on complete test results

BlitzzPay FedNow Simulator:

Nimbusnext’s BlitzzPay Simulator is a complete sandbox environment that simulates FedNow and the debtor/creditor banking environment. It is based on ISO 20022 message schema and a configurable set of business rules. It helps both the development and testing teams to build and test FedNow solutions thoroughly through an intuitive simulator environment. BlitzzPay simulator drives efficiency through realistic FedNow transaction simulations creating lifelike scenarios and business rules. It mimics various transaction types and volumes for thorough testing across use cases and edge scenarios. BlitzzPay Simulator ensures a rigorous evaluation of all functional workflows by integrating it with the existing systems through the Message Queue and APIs. The intuitive user interface and overall system minimize the learning curve for developers and testers. BlitzzPay Simulator is available in SaaS format as well as can be deployed in client data centers or the cloud environment. More details at www.blitzzpay.com

Critical requirements of Testers for testing FedNow Instant Payment Solutions

Testers in the FedNow system must meticulously examine and authenticate ISO 20022 messages across various scenarios. Given the 20-second settlement window in FedNow, testers must additionally conduct stress and performance testing on the relevant system components. The BlitzzPay Simulator seamlessly and intuitively supports these needs.

- Real-time scenario validation:The BlitzzPay simulator empowers testers to choose specific scenarios, such as customer credit transfer (pacs.008), and configure essential business rules at both the bank’s and FedNow levels. These configuration settings recreate real-life scenarios, boundary conditions, and error conditions within the simulated environment. After completing the configuration, the simulator can actively monitor incoming real-time messages on the message queue, providing appropriate responses based on the scenario type. This real-time validation enables testers to assess not only the ISO messages but also the comprehensive process flows within the banking systems.

- Chaos engineering:In real-world scenarios, ISO 20022 message flows can encounter adverse conditions within the network and external systems. For instance, network latencies between the bank and FedNow, slow responses from FedNow systems, or downtimes in receiving banks may occur. It is imperative to simulate such chaotic conditions and thoroughly test how bank systems respond to them. The BlitzzPay Simulator facilitates these requirements through its chaos configuration settings.

- Stress, edge, and performance testing:In the realm of banking systems, the imperative is to generate, handle, and respond to real-time ISO messages at scale and with agility. Testers play a crucial role in validating these systems’ behavior and performance under varying message volumes and boundary conditions. The BlitzzPay Simulator empowers testers to create and assess such scenarios, ensuring a comprehensive validation of system capabilities.

- Configurable rules:Beyond the business rules governing ISO 20022 messages, numerous overarching business rules apply to all participants in the FedNow instant-payment ecosystem. Testers must adeptly configure these rules to simulate diverse scenarios, covering aspects such as transaction amount limits and the active status of bank accounts. Leveraging a configurable rules framework, the BlitzzPay Simulator empowers testers to easily modify these configuration settings through an intuitive user interface, facilitating seamless adaptation to various testing scenarios.

- Bulk message validation (offline):For offline message testing scenarios, testers require the capability to assess messages in bulk for adherence to schema and compliance with business rules. The BlitzzPay Simulator offers a feature to validate messages in bulk, allowing testers to upload or drag-and-drop a zip file containing multiple messages and receive a comprehensive report at the individual message level. This functionality streamlines the validation process, enhancing efficiency in ensuring schema adherence and business rules conformance.

The BlitzzPay Simulator encompasses numerous capabilities and features designed to empower testers, facilitating efficient and effective testing of FedNow messages and systems.

Take the next step! Explore further details about the BlitzzPay Simulator at www.blitzzpay.com or reach out via email at blitzzpay@nimbusnext.com. Whether you’re interested in a brief demo or have specific questions, we are here to assist and tailor our support based on your needs.